Real-Time Compliance for the Insurance Industry

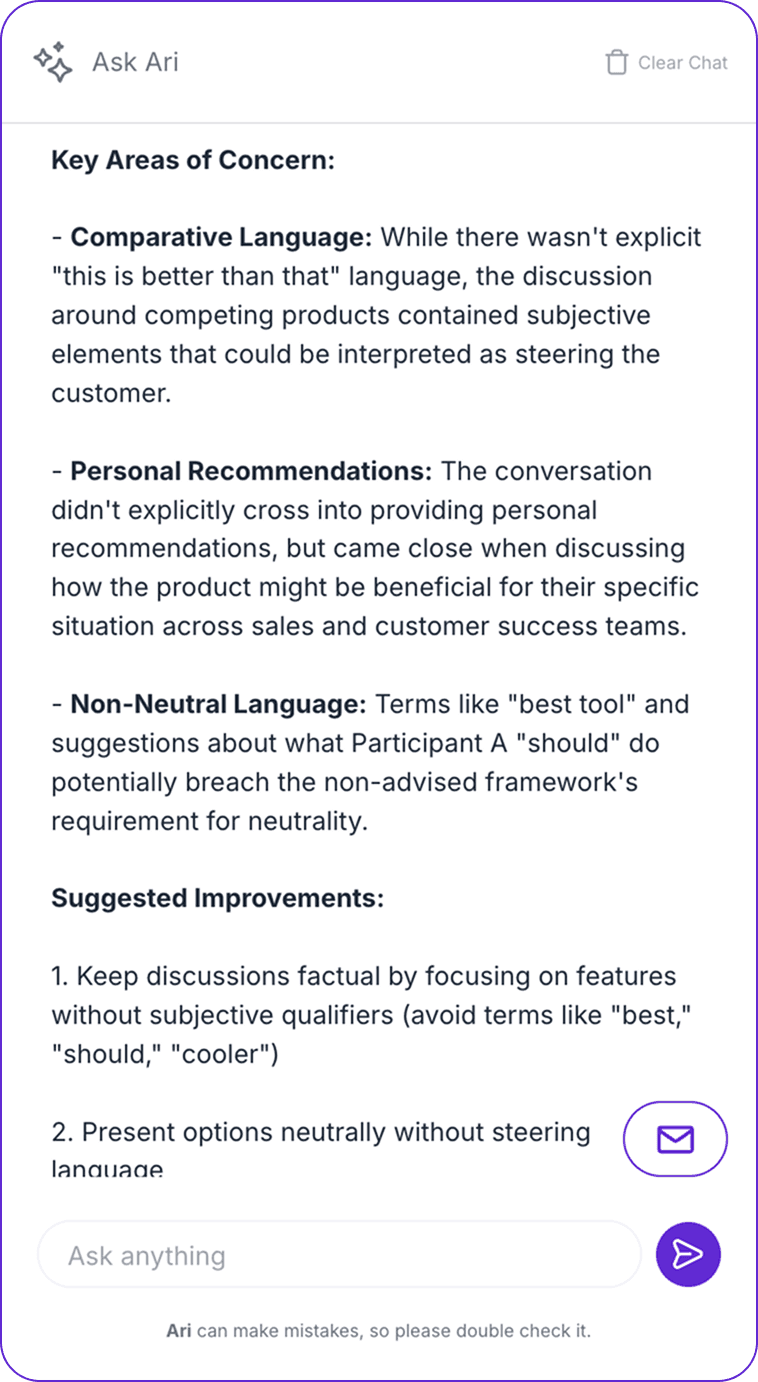

Auditing vast volumes of past interactions is slow, resource-intensive, and often only catches issues long after they occurred.

Full Interaction Analysis: We retroactively analyse 100% of recorded interactions (calls, chats, emails) against current and historical regulatory standards.

Targeted Remediation: Identify patterns of non-compliance, isolate problematic agents or scripts, and prioritise cases that require immediate remedial action or customer outreach.

Automated Documentation: Generate detailed, tamper-proof audit trails for every interaction, demonstrating full adherence to regulatory bodies when required.

Benefit: Always on working in the background to ensure all compliance auditing is done automatically.

Achieving compliance often comes at the expense of conversation quality, sales opportunity, or customer experience.

Compliant Conversion Optimisation: Analyse compliant interactions that lead to positive outcomes (sales, high CSAT scores). Our platform extracts the best compliant practices.

Guided Best Responses: Ensure the "right things are said and the right responses are given all the time" by feeding successful, compliant dialogue patterns back into the real-time guidance system.

Performance Benchmarking: Identify high-performing, highly-compliant agents and use their conversational style as a model to uplift the entire team's performance.

Turn compliance from a mandatory checklist into a competitive advantage, optimising conversations for both regulatory safety and positive business results.